April 2nd, 2025

How To Use A Budget Planner

If you feel like you can't get a firm grip on your finances, then it's time to start using a budget planner.

But, like any tool, it's how you use it that counts.

Creating a budget requires time and effort, so let's take a look at how you can use your planner to achieve financial success.

Choose The Right Budget Planner For Your Needs

The format of your budget planner matters. Everyone's financial situation is unique, so the planner you pick has to fit your needs.

An unsuitable planner won't get used consistently and won't be effective in helping you organize your finances.

- So, do you prefer a paper budget planner or an electronic version?

- Do you require daily tracking or is monthly or weekly more suitable?

- What about the layout? Do you like vertical formats? Or are horizontal or grid formats better?

Pick a planner that has budgeting add-ons or customizable options, such as planner dashboards or goal trackers. . As you dive into this article, you’ll discover the key features of a planner that can empower you to build a bright and secure financial future - making the journey exciting and rewarding!

Step 1: Perform A Financial Audit

Now that you have your ideal planner, let's jump into what you need to do next: perform a thorough financial audit to determine your income and expenses.

Calculate your net monthly income

First, you must understand how much money is coming in each month. This covers all your income sources, including:

- Your monthly income

- Your partner's monthly income

- Investment income

- Benefits such as tax credits, social security, or disability support

- Side-hustle earnings

If you're self-employed or you're paid hourly, then calculating your actual take-home pay can be difficult, as it can vary each month.

If this is the case, we recommend adding up your previous 12 months' worth of take-home pay and then dividing it to get an average. Additionally, if you frequently work overtime, receive bonuses or commission, take an average of these too.

Calculate your monthly expenses

The next step is to calculate your monthly expenses, of which there are two types: fixed and variable expenses.

Fixed expenses

Fixed expenses are consistent monthly outgoings.

These include:

- Rent or mortgage payments

- Insurance premiums

- Subscriptions (internet, streaming services, gym membership, etc.)

- Loan repayments and minimum credit card debt repayments

- Other fees such as HOA, tuition, and daycare

Fixed expenses are easy to calculate, but don't overlook the smaller ones. For instance, low subscription payments for things like streaming services may only cost a few bucks a month, but soon add up if you have a lot of them.

Variable expenses

Variable expenses are the outgoings that occur monthly but fluctuate depending on usage or need.

These include:

- Utilities (electricity, water, gas, etc.)

- Groceries, personal care items, and household supplies

- Transport (fuel, public transport fares, etc.)

- Leisure and entertainment (takeouts, restaurants, kids activities, hobbies, etc.)

It's crucial to be honest with yourself when calculating variable expenses because these can take up a larger chunk of your expenditure than you may realize.

Understand your spending habits

Although you've calculated your monthly income and expenses, it's still only part of the puzzle.

You also need to understand how you spend your money.

Use a spending tracker and note down everything you spend money on. From your morning trip to the coffee shop to car repairs and everything in between, record every transaction meticulously.

If you track your spending for a few weeks, it will reveal trends and patterns that can be managed better. The more knowledge you have about your spending habits, the more intentional you can be about setting and achieving financial goals.

Step 2: Set Achievable Goals

You now have all the information you need to start setting your financial goals.

However, it's crucial that you don't just focus on the short-term. Your longer term goals matter too.

Short-term financial goals

Short term goals refer to the things that can be achieved in the coming months or up to one year.

Some examples include:

- Reducing your grocery bills

- Building an emergency fund

- Paying off smaller debts

- Saving for a vacation

- Upgrading appliances

- Improving your credit score

Medium-term financial goals

Your medium-term goals are harder to achieve than short-term ones and require a little more planning and consistency. For example:

- Saving for a down payment on a home

- Clearing larger debts like car or student loans

- Starting a business or study fees for a career change

- Saving for a big/luxury vacation

Long-term financial goals

Finally, your long-term goals are the ones that take place over many years. They require a lot of discipline and patience to achieve. Examples include:

- Paying off your mortgage

- Retirement savings

- Kids college funds

- Achieving financial independence

- Estate and legacy planning

Step 3: Create A Monthly Budget

Now, we pull everything together into the master plan!

Your monthly budget will be the roadmap for how you reach your financial goals. So, it's important to be as detailed as possible. Define categories for your fixed expenses and variable monthly expenses and allocate an amount to each.

Set discretionary spending limits for "nice to have but not necessary" items. Meals out, leisure activities, clothes shopping, etc. Look at what's left over and decide where to allocate it. For example, are you going to focus on savings goals, or is your main aim to bring down debt?

If there's still money left over, set it aside as an emergency fund.

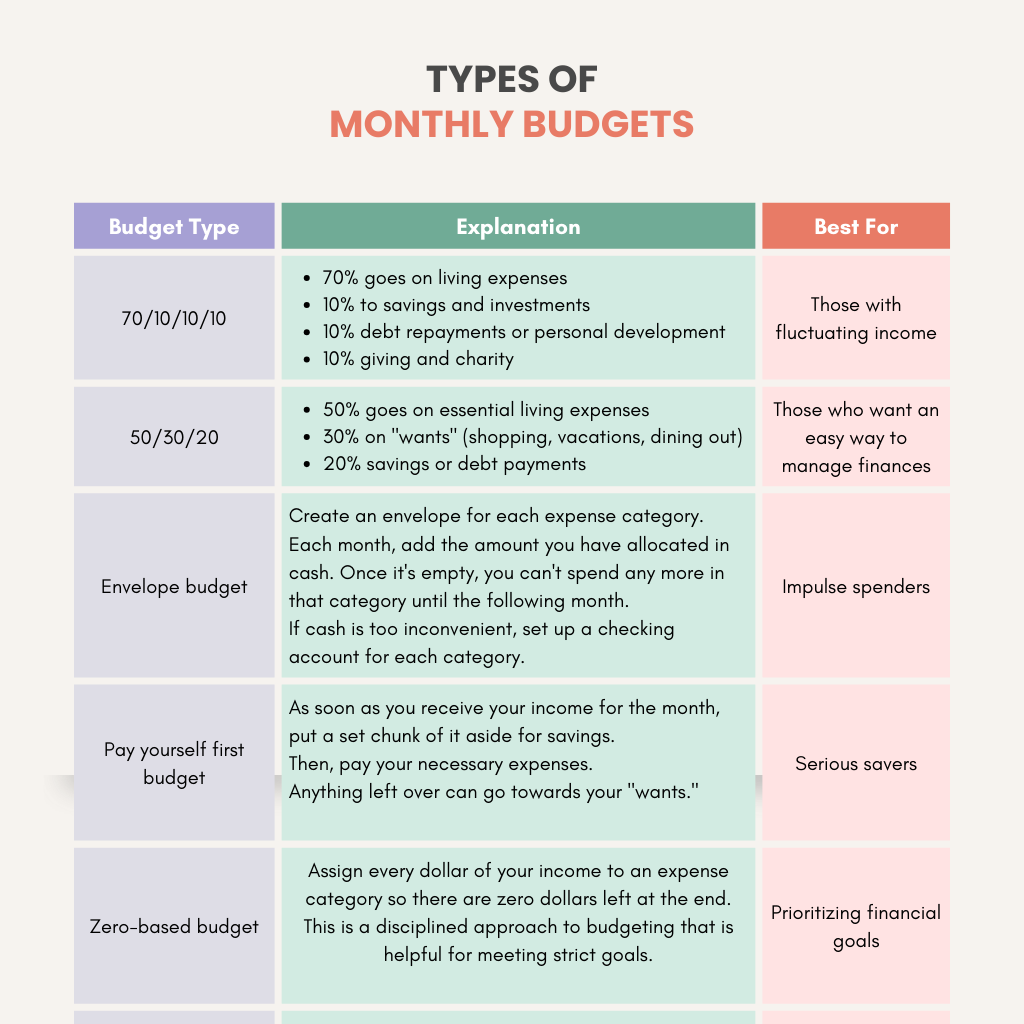

When creating a budget, it helps to use a tried and tested method. Here are some of the most popular:

.png)

Step 4: Track Spending And Adjust

The budget is set! Now, it's time to start tracking and maintaining a close eye on your actual spending.

Keep account of your expenditure against your budgeting system. For the most accuracy, it's best to do this daily.

Remember to check your bank statements regularly for anything you may have missed, and don't forget to keep a receipt of anything you purchase with cash.

If you find you're overspending each month or not meeting your goals, then adjust your budget and your habits accordingly.

Step 5: Regularly Pause And Reflect

Financial planning is always a work in progress and it requires consistent effort and input. So, find moments to reflect and write down your achievements, what you are proud of, and what you are grateful for.

If you slip up, don't be tough on yourself. Budgeting is hard!

Instead of dwelling on mistakes, look at what you can change so they don't happen again. Also, recognize that your priorities will shift over time. Therefore, be mindful to update these throughout your planner to ensure you're always focusing on the right things.

Top Tips For Better Budget Planning

- Set up automatic transfers for savings. If the money goes straight into your savings account, you'll be less tempted to spend it.

- Set up automatic payments for bills. This way, you'll ensure they're paid and you'll avoid late fees.

- Use a financial planner you can easily access and update.

- Switch to a prepaid card or cash for discretionary costs, as this makes it harder to overspend than it is with a credit card.

- Stick to a list when grocery shopping and try meal planning for even better control.

- Cancel unused subscriptions and memberships. If you haven't been to the gym in a year, it's time to ditch it.

- Assign no-spend days or set yourself a no-spend challenge.

Above all, learn to love the process of budget planning! Seeing your debt reduced or your savings increased is incredibly rewarding. Look forward to seeing those balances change each month and congratulate yourself each time they do.

Frequently Asked Questions

What are the first 5 things you should list in a budget?

When developing a budget, the first five things you should list are:

- Total net income

- Housing and insurance premiums

- Utilities

- Groceries and essentials

- Current debts

What is a good monthly budget?

A good monthly budget provides financial stability by ensuring your essential expenses are prioritized and accounted for. Additionally, it leaves money left over for saving and reducing debt.

A good budget also defines goals and can provide you with a path toward achieving them.

Final Thoughts

Budgeting is never an easy task, but a financial planner will help you organize and structure your finances properly.

Whether you want to prepare for retirement, save money for large purchases, or simply reduce stress, using a budget planner will help you meet your financial goals.